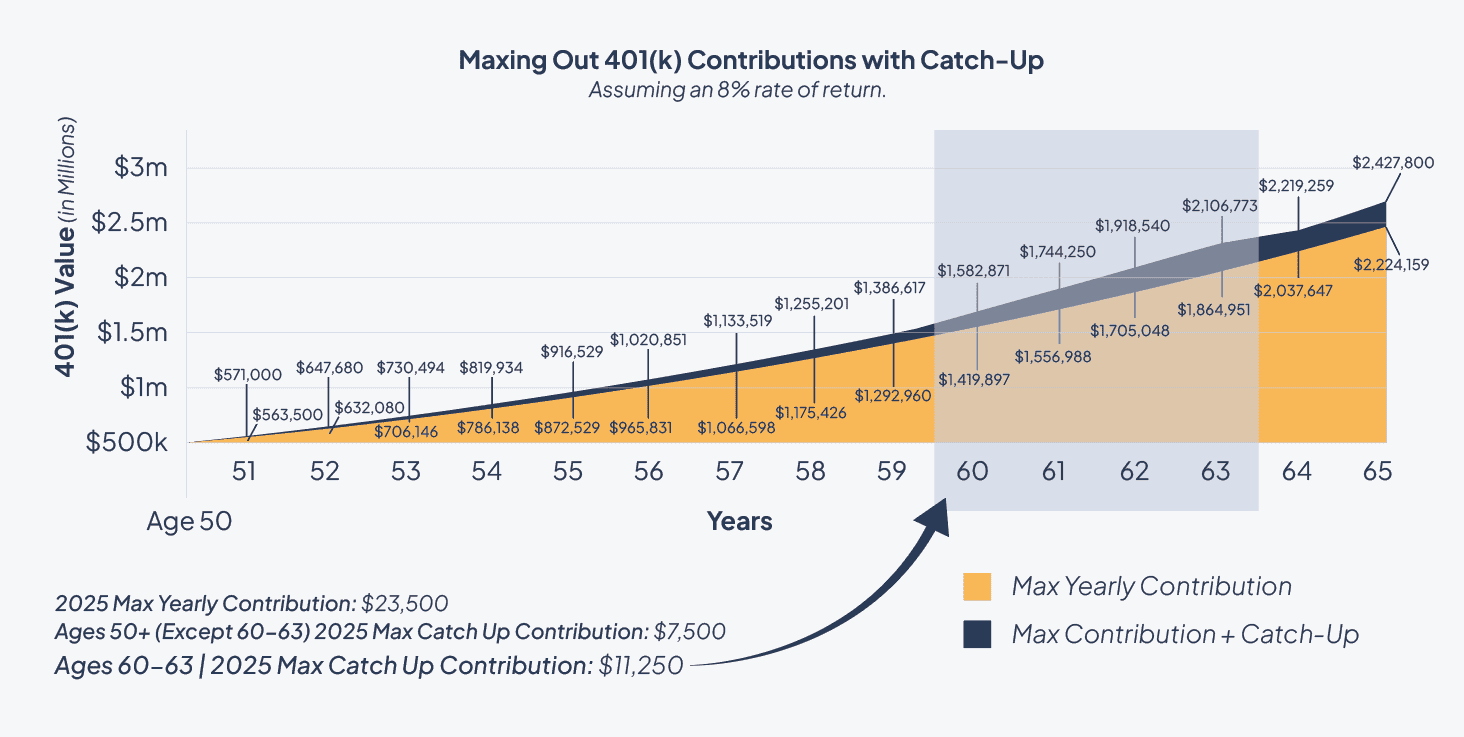

Ira Contribution Limit 2025 Catch Up. The salary deferral limit for employees who participate in 401 (k) plans,. Under a provision of secure act 2.0, plan participants in a specific age group can now boost their contributions to 401(k) and related plans.

So, these taxpayers can still contribute an additional $7,500 in 2025 ($31,000 total). The annual ira contribution limit will remain $7,000.

Roth Ira Max Contribution 2025 Limits Over 50 Warren Metcalfe, The total employee contribution limit to all 401(k) and 403(b) plans for those under 50 will be going up from.

2025 401k Catch Up Contribution Limits 2025 Pdf Download Sam Churchill, The simple ira contribution limit has increased to $16,500, up from $16,000 in 2025.

2025 401(k) and IRA Contribution Limits Modern Wealth Management, 401(k) contribution limit for 2025.

Higher CatchUp Contribution Limits in 2025 YouTube, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Traditional Ira Contribution Limits 2025 Mari Annaliese, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

401k Limits 2025 Catch Up Rebecca Terry, The salary deferral limit for employees who participate in 401 (k) plans,.

Roth Ira Contribution Limits 2025 Pdf Download Lily Mitchell, Under a provision of secure act 2.0, plan participants in a specific age group can now boost their contributions to 401(k) and related plans.

IRA Contribution Limits in 2025 Meld Financial, Under a provision of secure act 2.0, plan participants in a specific age group can now boost their contributions to 401(k) and related plans.

Ira Contribution Limits 2025 Catch Up Limits Heda Pearle, The salary deferral limit for employees who participate in 401 (k) plans,.

Viking Cruises 2025 Europe Itinerary. Discover berlin’s modern chic, potsdam’s rococo whimsy and prague’s gothic […]